ETH Price Prediction: Analyzing the Path to $5,000 Amid Strong Fundamentals

#ETH

- Technical Strength: MACD bullish divergence and consolidation above key support levels suggest upward momentum potential

- Fundamental Growth: Record staking activity and institutional ETF inflows provide solid foundation for price appreciation

- Ecosystem Development: Expanding Layer 2 solutions and new stablecoin initiatives enhance Ethereum's utility and value proposition

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Pressure

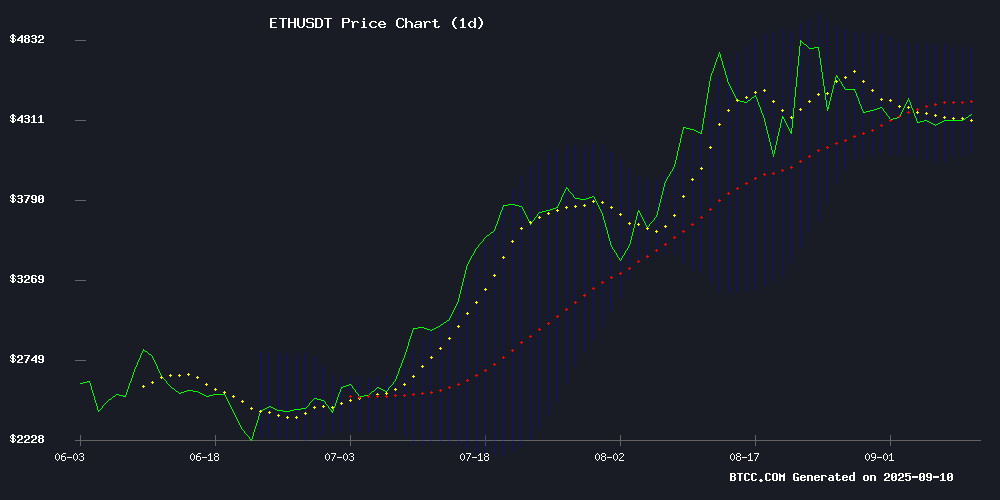

ETH is currently trading at $4,345.63, slightly below its 20-day moving average of $4,437.45, indicating potential short-term consolidation. The MACD reading of 170.44 with a positive histogram of 83.69 suggests strong bullish momentum remains intact. Bollinger Bands show ETH trading within the upper ($4,781.62) and lower ($4,093.27) bands, with the middle band at $4,437.45 providing dynamic support. According to BTCC financial analyst Sophia, 'The technical setup suggests ETH is building a solid foundation for another push toward the $5,000 level, with the MACD divergence particularly encouraging for bulls.'

Market Sentiment: Institutional Interest and Staking Growth Support ETH's Bull Case

Positive developments across multiple fronts are fueling optimistic sentiment for Ethereum. The record 2 million ETH staked demonstrates strong long-term commitment from investors, while $44.16 million in ETF inflows indicates growing institutional interest. Despite the SEC's delay on BlackRock's staking proposal and validator slashing incidents, the overall narrative remains constructive. BTCC financial analyst Sophia notes, 'The combination of institutional ETF flows, record staking activity, and LAYER 2 developments like Upbit's GIWA launch creates a fundamentally strong environment for ETH's appreciation toward $5,000.'

Factors Influencing ETH's Price

Ethereum Eyes $5,000 as Investor Interest Shifts to Emerging PayFi Token Remittix

Ethereum's price trajectory dominates crypto discussions, with analysts projecting a September 2025 target of $5,000—potentially reaching $5,171 if network strength persists. The current trading price of $4,299.85 reflects growing institutional adoption and DeFi expansion, cementing ETH's ecosystem dominance.

Despite Ethereum's steady climb, 90% of new investors this month are bypassing the established asset for Remittix, a PayFi project gaining traction through real-world utility and exchange momentum. Market participants view Remittix as offering exponential growth potential compared to Ethereum's gradual appreciation.

The divergence highlights a broader market trend: while blue-chip cryptocurrencies maintain bullish long-term outlooks, capital increasingly flows toward high-growth alternatives promising immediate upside. Ethereum's infrastructure advantages face competition from nimble projects delivering tangible use cases.

SEC Delays Decision on BlackRock Ethereum ETF Staking Proposal

The U.S. Securities and Exchange Commission has extended its review period for BlackRock's proposed Ethereum ETF staking feature, pushing the decision deadline to October 30. The world's largest asset manager seeks to offer investors exposure to Ethereum alongside staking rewards—a feature now under heightened regulatory scrutiny.

This marks a pattern of deliberate evaluation by the SEC, which recently delayed similar proposals from Cboe and NYSE for 21Shares and Grayscale's Ethereum ETFs. Regulatory caution reflects growing institutional demand for crypto yield products amid an evolving policy landscape.

Ethereum Staking Hits Record High with 2M ETH Locked, Fueling Bullish Momentum

Ethereum staking has reached a new all-time high, with over 2 million ETH now locked in Beacon Chain validator contracts. This milestone underscores growing confidence in Ethereum's proof-of-stake architecture, as compounding validators—those reinvesting staking rewards—have doubled their ETH holdings in just one month. Data from Everstake.eth reveals these validators now control 2.026 million ETH, representing 5.67% of all staked Ethereum.

The price of ETH has edged up to $4,405.88, a 2.34% increase on the day, as staking confidence builds. Trading volume remains steady at $33.78 billion, with the market eyeing a potential breakout toward $5,000. Unlike the 2021 cycle, this rally is driven by locked supply, whale activity, and structural demand rather than hype.

Whale inflows have surged, with $2.5 billion entering the market in the past 48 hours. Large holders are reloading positions, signaling renewed institutional interest. The convergence of record staking levels and whale accumulation suggests mounting pressure for a significant upward move.

Ethereum Validators Slashed in Rare Mass Penalty Event Linked to Infrastructure Issues

Ethereum's proof-of-stake chain witnessed one of its largest coordinated slashing events this week, with 39 validators penalized for duplicate block proposals. The incident—tracked by Beaconcha.in—stemmed not from protocol flaws but operational missteps by third-party staking providers using SSV Network's distributed validator technology.

Two clusters triggered the penalties: Ankr's liquid staking service during routine maintenance, and a migrated validator group previously managed by Allnodes. One affected validator forfeited 0.3 ETH ($1,300) from its 2,020 ETH stake. While slashing remains rare—designed as Ethereum's anti-fraud mechanism—this event highlights growing pains in decentralized staking infrastructure.

Sharplink Launches $1.5B Share Buyback Amid Undervalued Stock and Heavy ETH Staking

Sharplink, the second-largest Ether treasury holder, has initiated a $1.5 billion stock repurchase program as its shares trade below net asset value. The move follows 939,000 shares bought back at $15.98 average price, targeting NAV per share accretion.

Nearly all of Sharplink's $3.59 billion ETH holdings remain staked for yield generation. "We're prioritizing capital discipline over equity issuance while undervalued," stated Co-CEO Joseph Chalom, echoing analyst recommendations for crypto treasuries to deploy buybacks during NAV discounts.

LitFinancial Launches Ethereum-Based Stablecoin litUSD to Revolutionize Mortgage Lending

LitFinancial, a Michigan-based mortgage lender, has introduced litUSD, a U.S. dollar-pegged stablecoin on the Ethereum blockchain. The move signals the expanding use of digital dollars beyond crypto-native applications, targeting traditional financial operations.

The ERC-20 token aims to reduce funding costs and enhance treasury management while exploring on-chain mortgage payment settlements. This innovation could enable public tracking of loan performance, potentially transforming liquidity dynamics in secondary mortgage markets.

Stablecoins continue gaining traction as payment alternatives, with Keyrock projecting $1 trillion in payment volume by 2030. Regulatory clarity from the U.S., including the recently signed GENIUS Act, has accelerated institutional adoption.

"Stablecoins are rapidly becoming an essential tool for modern treasury operations," said LitFinancial CEO Tim Barry. The 1:1 cash-backed litUSD represents a strategic pivot toward blockchain-enabled financial infrastructure.

Linea Resolves Sequencer Issue Ahead of Major Token Airdrop

Ethereum Layer-2 network Linea swiftly addressed a sequencer disruption on its mainnet, ensuring stability just as its token generation event commenced. The glitch, resolved within an hour, had briefly degraded network performance during Wednesday's early hours UTC.

Linea's airdrop distribution now proceeds unimpeded, targeting 749,000 wallets with 9.36 billion tokens until December 9. This strategic ecosystem incentive follows months of user engagement campaigns and secured listings on tier-1 exchanges including Binance.

The sequencer outage—critical infrastructure for transaction ordering—was diagnosed and patched with surgical precision. By 6:15 UTC, engineers implemented fixes, transitioning to monitoring mode within twenty minutes. Such technical responsiveness underscores Linea's operational maturity during pivotal network events.

Bitmine's $20M OCTO Stake Balloons to $628M Amid 3000% Stock Surge

Bitmine Technologies transformed a $20 million investment into a $628 million windfall within 24 hours as shares of Eightco Holdings (OCTO) skyrocketed 3000%. The Ethereum-focused treasury firm now holds 2,069,443 ETH after acquiring 202,469 ETH worth $881 million, cementing its position in the ecosystem.

OCTO's price surge to $78 intraday followed Eightco's Worldcoin Treasury announcement, pushing the stock to nearly 30 times its net asset value. Ark Invest capitalized on the momentum, purchasing 101,950 BMNR shares across its funds. "This moonshot reflects our conviction in Ethereum's infrastructure plays," said Bitmine CEO Tom Lee.

Ethereum ETFs See $44.16M Inflows as Bulls Eye $5K Price Target

Ethereum spot ETFs snapped a six-day outflow streak with $44.16 million in net inflows on September 9, signaling renewed institutional confidence. BlackRock's ETHA ETF absorbed the entire inflow, boosting its assets under management to $15.76 billion.

The resurgence pushed total Ethereum ETF assets to $27.39 billion, representing 5.27% of ETH's market capitalization. Analysts project a potential rally to $5,000-$9,000 by 2025, bolstered by yesterday's record $9 billion stablecoin inflow.

While other providers like Fidelity and VanEck saw flat activity, Grayscale's ETHE fund continues facing redemption pressures. The inflow reversal coincides with technical breakouts suggesting major upside potential.

SharpLink Gaming Executes $15 Million Share Buyback Amid Undervaluation Concerns

SharpLink Gaming (SBET) has repurchased $15 million worth of its own shares, citing significant undervaluation relative to its Ethereum holdings. The Nasdaq-listed company acquired 939,000 shares at an average price of $15.98, leveraging its $1.5 billion buyback program. The move comes as SBET trades at 0.87x net asset value—a discount to its $3.6 billion ETH treasury.

Nearly all of SharpLink's Ethereum reserves are staked, generating yield while the stock remains depressed. The disconnect mirrors broader declines in digital asset treasury firms, with sector valuations down 60-70% since July peaks. As a company led by Ethereum co-founder Joe Lubin, SharpLink's aggressive buyback signals conviction in its crypto-backed valuation model.

Upbit Launches GIWA, an Ethereum Layer 2 Solution Built on OP Stack

Dunamu, the operator of South Korea's largest cryptocurrency exchange Upbit, has unveiled GIWA, its proprietary Ethereum Layer 2 network. The move signals Dunamu's ambition to expand its blockchain influence beyond exchange services.

GIWA, an acronym for Global Infrastructure for Web3 Access, leverages Optimism's OP Stack to deliver one-second block confirmations—a significant improvement over Ethereum's native transaction speeds. The chain maintains full compatibility with Ethereum's Solidity programming language, enabling seamless migration of existing dApps and developer tools.

While currently in testnet phase, the network will soon launch with a native GIWA Wallet for token management and dApp interactions. At the Upbit D Conference 2025, CEO Oh Kyung-seok hinted at forthcoming financial utilities, though details remain undisclosed.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity. The cryptocurrency is demonstrating strong bullish momentum with supportive fundamentals including record staking activity, institutional ETF inflows, and growing Layer 2 ecosystem development.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $4,345.63 | Neutral |

| 20-day MA | $4,437.45 | Slight Resistance |

| MACD | 170.44 | Bullish |

| Bollinger Position | Middle Band | Consolidation |

| Staked ETH | 2M (Record) | Very Bullish |

| ETF Inflows | $44.16M | Bullish |

BTCC financial analyst Sophia emphasizes that while short-term volatility may persist, the combination of technical strength and fundamental growth drivers positions ETH favorably for medium to long-term appreciation.